2022 tax return calculator canada

The Canada Revenue Agencys goal is to send your refund within. 2021 free Canada income tax calculator to quickly estimate your provincial taxes.

Income Expense Tracker Printable Money Tracker Budget Etsy In 2022 Expense Tracker Printable Expense Tracker Business Expense Tracker

Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17 2022.

. The best free online tax calculator for Canada. Goodbye paperwork hello auto-fill. Seamlessly import your income tax slips and investment info from CRA Revenu Québec and Wealthsimple accounts to speedily complete your 2021 return.

To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Updated for 2022 the Canada Tax Return Calculator is a complex yet simple way to estimate your salary and payroll. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

The calculator reflects known rates as of January 15 2022. 2021 income tax calculators based on provinces. Here is a list of credits based on the province you live in.

That means that your net pay will be 40568 per year or 3381 per month. Please enter your income deductions gains dividends and taxes paid to. These timelines are only valid for returns that we received on or before their due dates.

Alberta tax calculator British Columbia tax calculator Manitoba tax calculator New Brunswick tax calculator Newfoundland and Labrador tax calculator Nova Scotia tax calculator Northwest Territories tax calculator Nunavut tax calculator Ontario tax calculator Prince Edward Island tax calculator. Meet with a Tax Expert to discuss and file your return in person. You simply put in your details get your refund estimation and then decide if you want to apply.

Consumer markets Engineering and construction Entertainment and media Financial services Government and Public Services Healthcare Industrial manufacturing Mining Power utilities Private equity Technology sector Telecommunications innovation Transportation and logistics. 2022 Ontario Income Tax Calculator. 8 rows Canada income tax calculator.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021. Calculations are based on rates known as of March 29 2022 and includes changes from the New Brunswick 2022 budget. Use our simple 2021 income tax calculator for an idea of what your return will look like this year.

Youll get a rough estimate of how much youll get back or what youll owe. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. We strive for accuracy but cannot guarantee it.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Assumes RRSP contribution amount is fully deductible. You have until June 15 2022 to file your return if you or.

This means that you are taxed at 205 from your income above 49020 80000 - 49020. We will also email a copy of your refund estimation through to your inbox so you can refer to it later. Your average tax rate is 220 and your marginal tax rate is 353.

Stop by an office to drop off your documents with a Tax Expert. Calculate your combined federal and provincial tax bill in each province and territory. Income Tax Calculator for Individuals.

Find out your federal taxes provincial taxes and your 2021 income tax refund. 2022 Personal tax calculator. 2 weeks when you file online.

Taking advantage of deductions. 2022 indexation brackets rates have not yet been confirmed to CRA data. Use our free 2022 Ontario income tax calculator to see how much you will pay in taxes.

You can also explore Canadian federal tax brackets provincial tax brackets and Canadas federal and provincial tax rates. Tax calculator 2022 PwC Canada. Quickly find all the forms deductions and credits you need to file easily all by searching simple keywords.

2021 2022 tax brackets and most tax credits have been verified to Canada Revenue Agency and. 2022 RRSP savings calculator. For example if your non-refundable credits total 20000 and your taxable income is 40000 you are in the first tax bracket.

Calculations are based on rates known as of March 16 2022. For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205. Use our tax refund calculator to find out if you.

Meet with a Tax Expert to discuss and file your return in person. This marginal tax rate means that your immediate additional income will be taxed at this rate. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or the.

8 rows If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. The average Canadian tax refund is 998 so check it out today.

The Canadian tax calculator is free to use and there is absolutely no obligation. 8 weeks when you file a paper return. Since April 30 2022 falls on a Saturday your return will be considered filed on time in either of the following situations.

Link your crypto wallets from multiple. The Canada Tax Calculator provides State and Province Tax Return Calculations based on the 20222023 federal and state Tax Tables. Or you can choose tax calculator for particular province or territory depending on your residence.

Start your 2021 tax for free. Calculate the tax savings your RRSP contribution generates in each province and territory. This calculator is for 2022 Tax Returns due in 2023.

Below there is simple income tax calculator for every Canadian province and territory. British Columbia tax calculator. This calculator is for 2022 Tax Returns due in 2023.

Income Tax Return Calculator Ontario 2022. The tax-filing deadline for most individuals is April 30 2022. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome.

Average tax rate taxes payable divided by actual not taxable. It includes very few tax credits. Returns may take up to 16 weeks if you live outside Canada and file a non-resident personal income tax return.

40000 x 15 20000 x 15 6000 3000 3000 in net federal tax. File your taxes the way you want. There are a variety of other ways you can lower your tax liability such as.

Reflects known rates as of January 15 2022. Province Tax Payable After-Tax Income Average Tax Rate Marginal Tax Rate. The 2022 Tax Calculator includes Federal and Province tax calculations for all income expense and tax credit scenarios.

This calculator is intended to be used for planning purposes. We strive for accuracy but cannot guarantee it. In Canada each province and territory has its own provincial income tax rates besides federal tax rates.

The Ultimate 5 Property Rental Real Estate Template Excel Etsy In 2022 Rental Property Management Real Estate Investing Rental Property Rental Property Investment

Airbnb Rental Income Statement Tracker Monthly Annual Etsy Rental Income Airbnb Rentals Rental Property Management

Capital Gains And Losses Taxes On Investment Property Sale 2019 In 2022 Investment Property Financial Strategies Tax Questions

2021 2022 Income Tax Calculator Canada Wowa Ca

Mohawk Revwood Plus Hartwick Laminate Cdl90 In 2022 Waterproof Laminate Flooring Laminate Installation Underfloor Heating Installation

Do You Need Investment Management Help Then Check Out Betterment One Of The Earliest Roboadvisors Now Offe Cash Management Robo Advisors Financial Advice

2019 Canadian Tax Tips My Road To Wealth And Freedom Canadian Money Tax Refund Finances Money

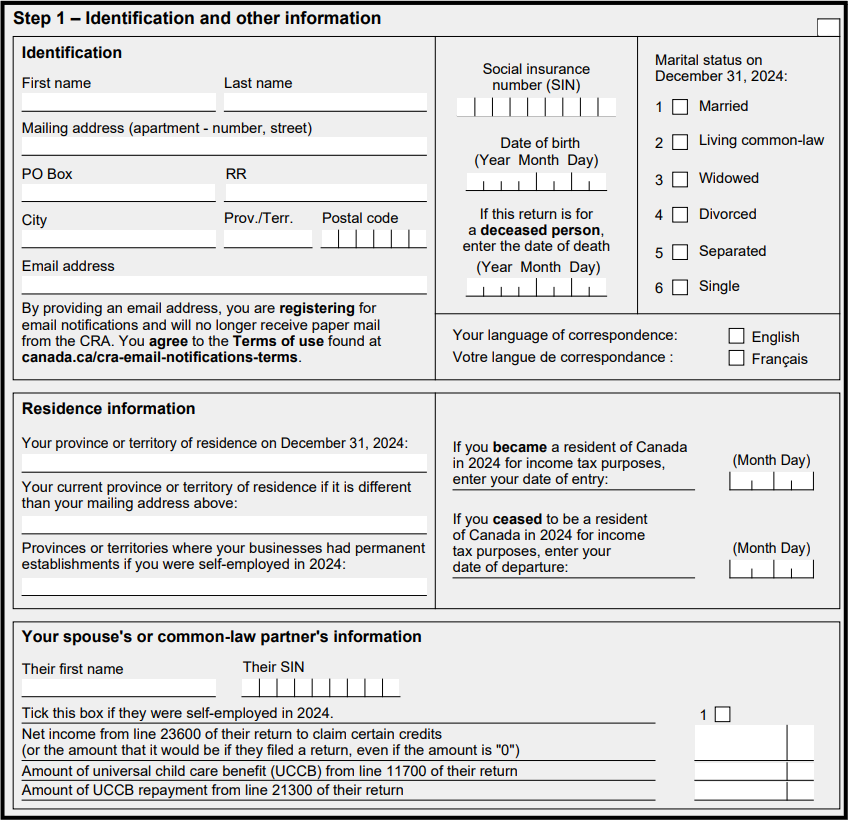

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

7 Secrets People Who Retire Comfortably Know About Financial Advisors Financial Advisors Advisor Financial

Investment Property Analyzer Rental Property Calculator Etsy Investment Property Investing Rental Property Management

Know Your Worth Then Add Tax Taxreliefcenter Inspiration Preparing For Retirement Best Money Saving Tips Tax Prep

Pin On Retirement Eol Planning Rving

Pink Rose Printable Accounting Ledger Bookkeeping Journal Etsy In 2022 Accounting Bookkeeping Business Expense

In The United States The Internal Revenue Service Requires That Individual Taxpayers Who Have Not Had Sufficie Inheritance Tax Tax Deductions Tax Free Savings

Sure Fire Ways To Enhance The Value Of Your Home Realty Times In 2022 Current Mortgage Rates Mortgage Rates Today Best Mortgage Lenders

Online Payment Invoice Tax Bills Accounting Services Vector Isometric Concept Accounting Payment Isometric Pay Accounting Online Payment Accounting Services